General Liability Insurance For Llc

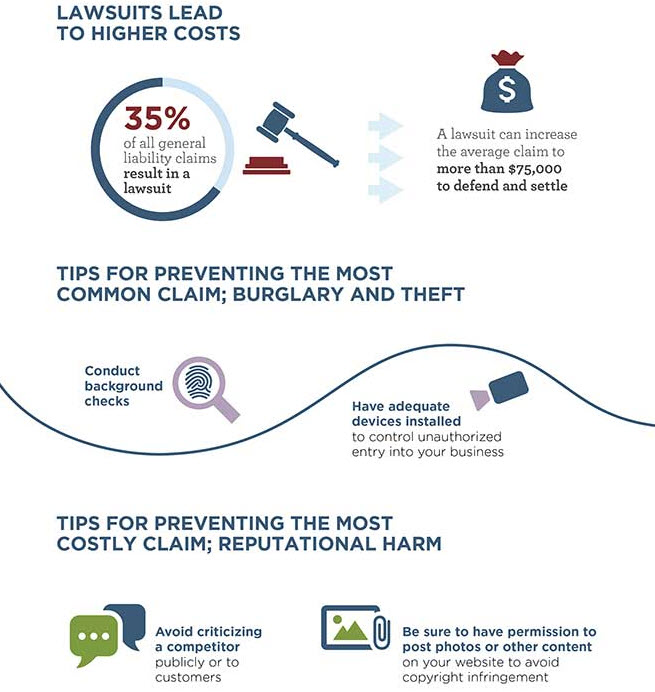

For example if an injured customer sued and you didnt have liability insurance your LLC could go out of business. So if a customer trips over a loose wire at your business and breaks their wrist general liability.

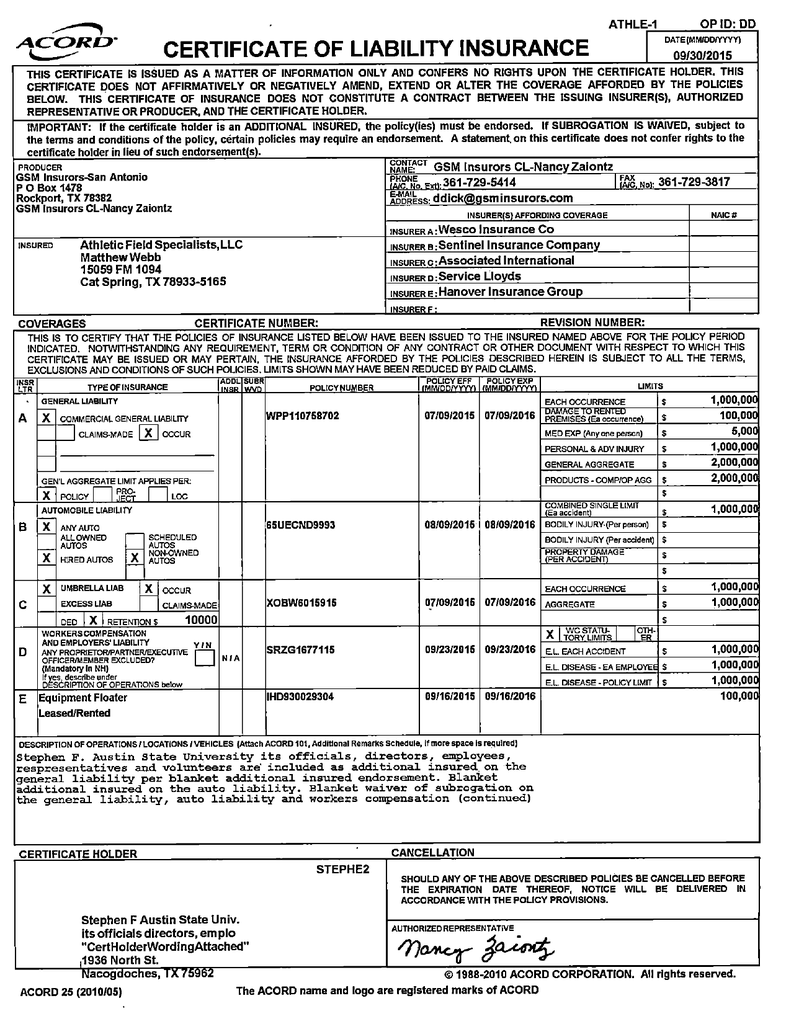

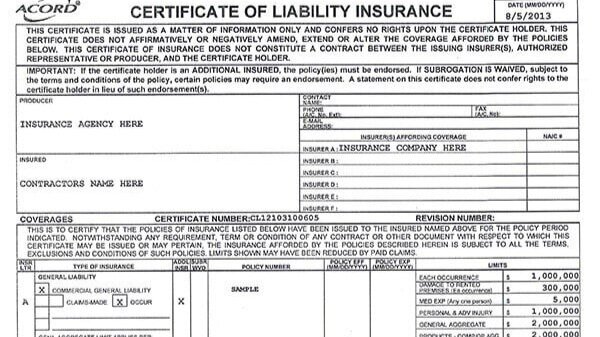

How To Read A Certificate Of Insurance Part I General Liability Grow Green Insurance Services

You Could Save 500 or More on Car Insurance.

General liability insurance for llc. Switch to GEICO and You Could Save Today. Protection against the risk of damages. Ad Dont Overpay for Auto Insurance.

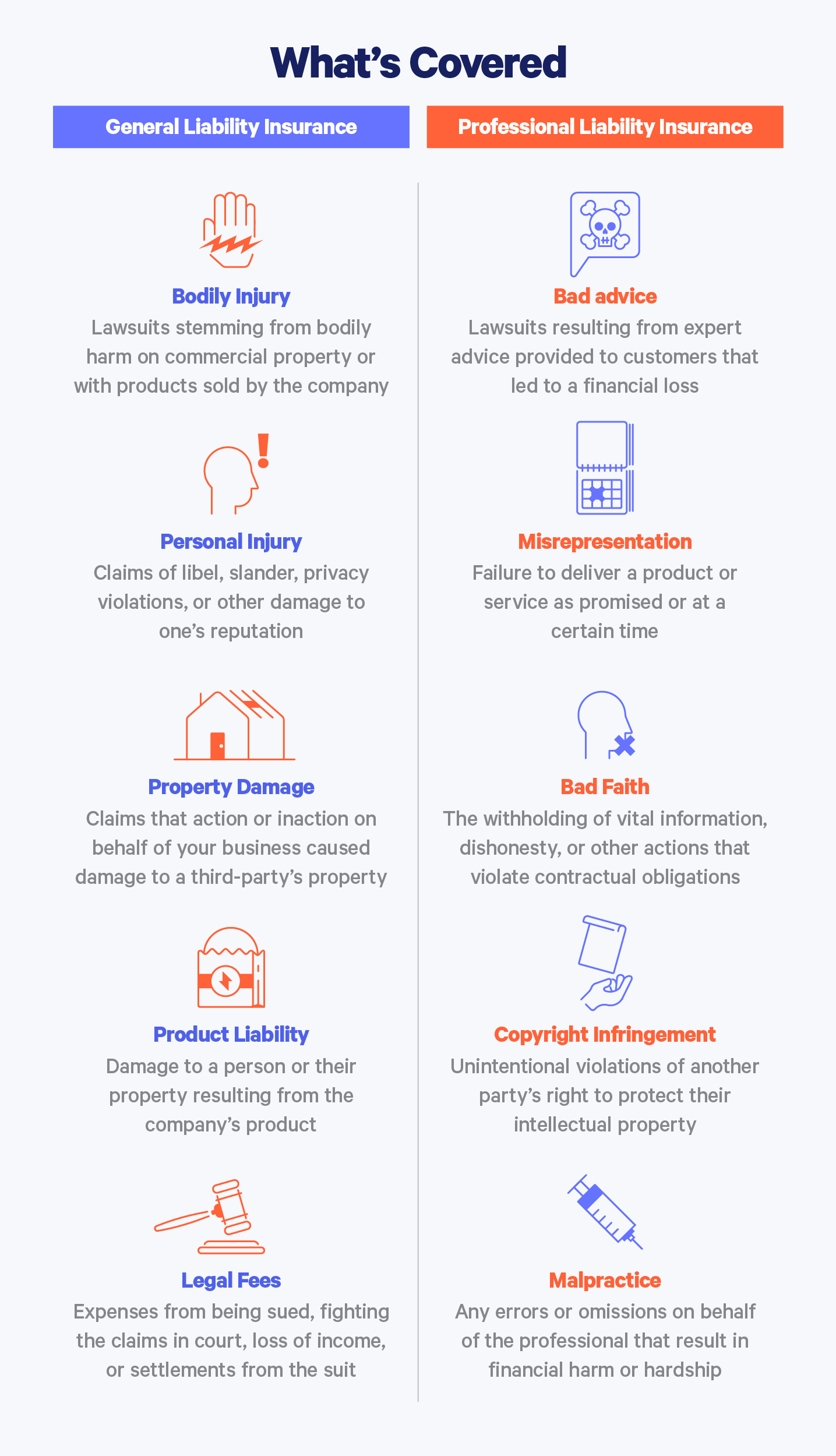

General liability insurance coverage can protect your LLC if someone is injured on your businesss property and it covers damage caused by you or your employees. General liability insurance GL often referred to as business liability insurance is coverage that can protect you from a variety of claims including bodily injury property damage personal injury and others that can arise from your business operations. Bodily injury or property damage that your business caused.

These exposures could be just about anything including liability engendered by accidents from the operations of the insured party contractual liability products manufactured by the insured party etc. A few exceptions to this principle include data loss and reputation damage for example if one of your business staff members defames a client. A few exceptions to this principle include data loss and reputation damage for example if one of your business staff members defames a client.

General liability insurance mainly covers bodily injury to people outside of your business and physical damage to their property. However a Limited Liability Company LLC gives you insulation from any potential losses that your business might suffer. Well work with you to determine your business risks and well assist you in developing an insurance package that makes sense for your business.

General liability insurance helps protect your small business from the consequences of third party claims for injury or property damage. General liability insurance protects your LLC in cases where a third partylike a customer client vendor or visitorgets hurt or suffers some sort of property damage on your premises or because of your business. With an LLC you can mitigate your risks.

The policy will cover your legal defense and the costs associated with the loss if you. However even if you structure your business as an LLC your assets could still be exposed particularly if you are accused of being negligent. General liability insurance coverage can help protect your LLC from claims of.

General liability insurance is intended to guard operators and owners of companies from claims that may come from a broad spectrum of sources. While an LLC provides some protection from personal liability for members the protection is not absolute and your business can still be sued. You Could Save 500 or More on Car Insurance.

General Liability Insurance General liability insurance provides you with specific coverage that can protect you from diverse business related claims including bodily injury property damage personal injury and other type of injury or damage that can arise from your business operations. A general liability insurance policy also known as business liability insurance can help protect you from claims alleging your LLC caused bodily injury or property damage. Ad Dont Overpay for Auto Insurance.

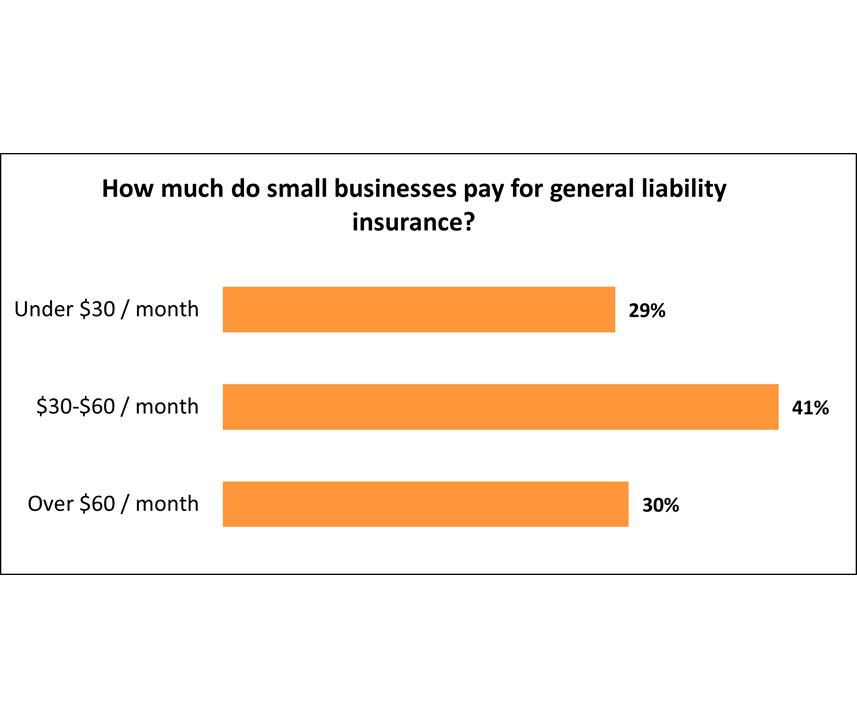

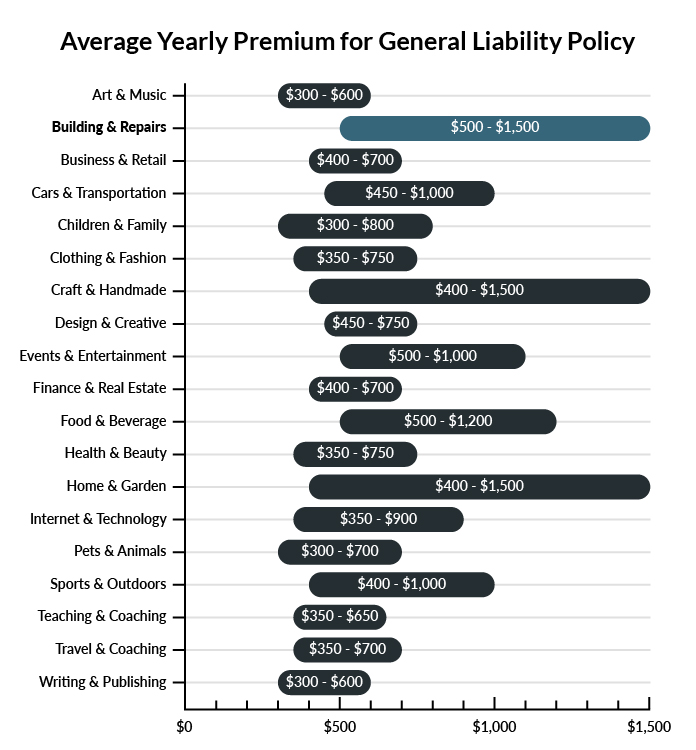

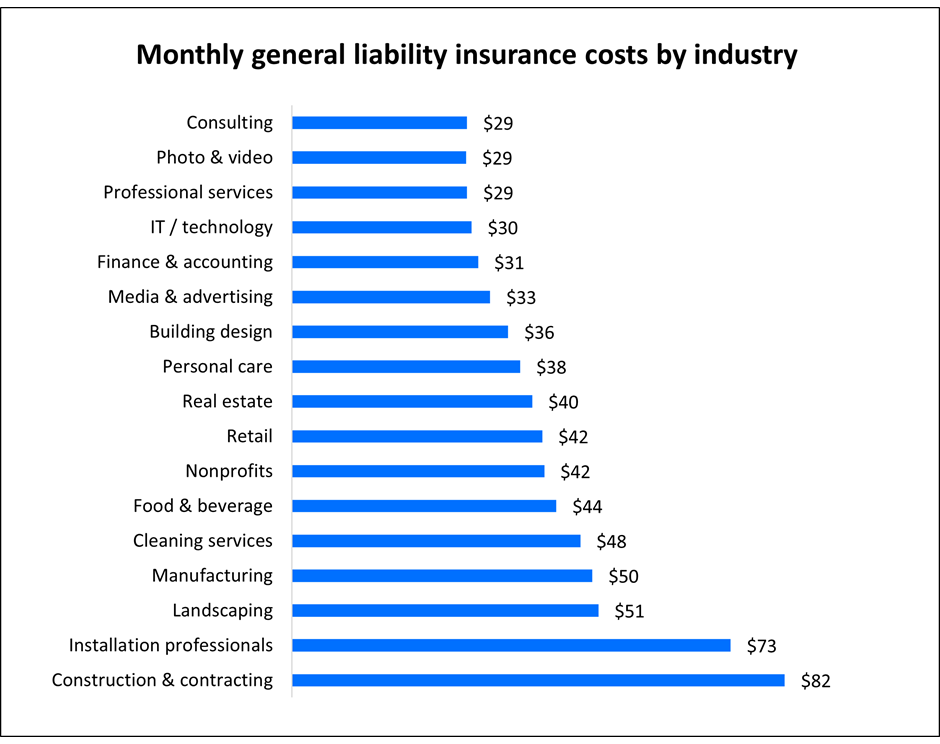

The average price of a standard 10000002000000 General Liability Insurance policy for small limited liability companies ranges from 27 to 49 per month. Should you get general liability insurance for your LLC. These exposures could be just about anything including liability engendered by accidents from the operations of the insured party contractual liability products manufactured by the insured party etc.

LLC liability insurance can help cover claims that come up during everyday operations. Why should you get general liability insurance. General liability insurance provided by rachas Group LLC.

General liability insurance is intended to guard operators and owners of companies against claims that may come from a broad spectrum of sources. No matter the size and nature of your business there are always uncertainties. Think about the kind of risks your business faces in these kinds of situations.

Simply put LLC insurance is really just a combo of general and professional liability policies designed to help protect your company against claims of injury caused by your business employees faulty products or a professional error. Operating without liability insurance puts your LLC at risk if something happens to anyone on the premises. General liability insurance mainly covers bodily injury to people outside of your business and physical damage to their property.

Like other policies your liability insurance can be customized to more specifically fit the needs of your LLC. Switch to GEICO and You Could Save Today.

General Liability Vs Professional Liability Insurance Coverage Embroker

Everything You Need To Know About Certificates Of Insurance Bcs Compliance

General Liability Insurance Business Liability Insurance

Certificate Of Liability Insurance

General Liability Insurance Business Liability Insurance

How To Read A Certificate Of Insurance Part I General Liability Grow Green Insurance Services

How Much Does General Liability Insurance Cost The Hartford

General Liability Vs Professional Liability Insurance Coverage Embroker

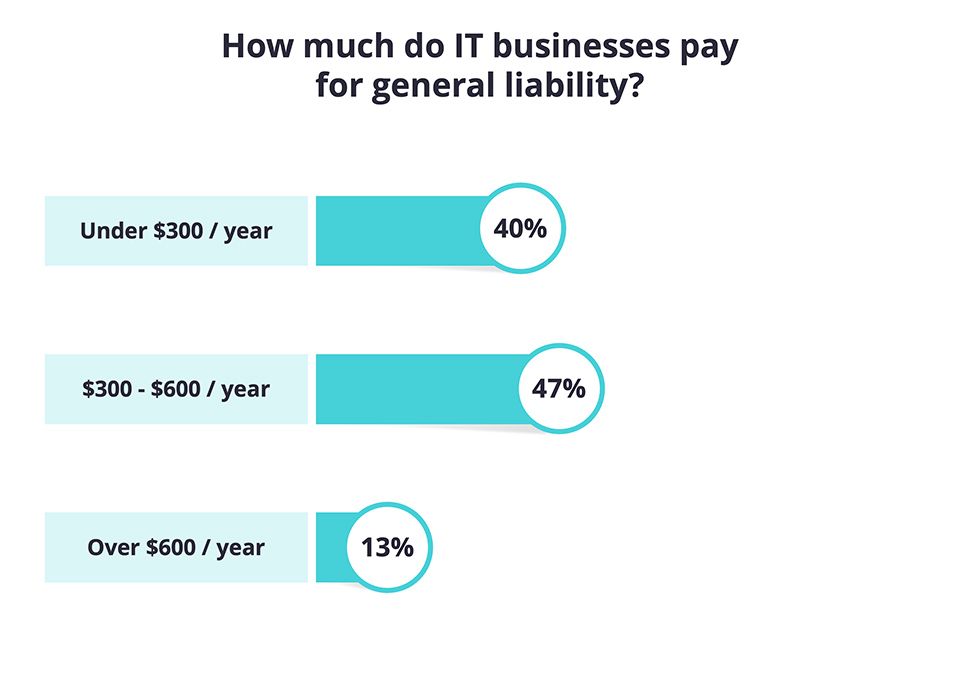

Commercial General Liability Insurance Cost Techinsurance

General Liability Insurance For Small Business Coverwallet

How Much Does General Liability Insurance Cost The Hartford

General Liability Insurance Cost Insureon

Business Insurance For Cleaning Companies How To Start An Llc

General Liability Insurance For Small Business Coverwallet

How Much Does General Liability Insurance Cost Commercial Insurance

![]()

Commercial General Liability Declarations Cg Ds 01 Ethan S Blog

General Liability Insurance For Small Business Coverwallet

General Liability Vs Professional Liability Insurance Coverage Embroker

Post a Comment for "General Liability Insurance For Llc"