Insurance Policy Definition Of Dwelling

Dwelling insurance is a policy that provides coverage to the physical structure of a home and any structure attached to it including sheds garages and patios. In some circumstances it may be increased or decreased if needed depending on your situation.

Buy Home Insurance House Insurance Policy Which Will Protect Not Only Your Home But Also The Belongings Content Home Insurance Homeowner Insurance Policy

The Dwelling Extension or Other Structures feature covers all structures that.

Insurance policy definition of dwelling. Or personal property limit is usually a percentage of the insured dwelling amounttypically 70 of the insured dwelling value. Dwelling coverage also known as dwelling insurance or Coverage A is the part of your homeowners insurance that helps pay to rebuild or repair the physical structure of your. Unlike homeowners forms these policies do not insure liability or medical payments exposures.

Dwelling insurance is a type of insurance policy used to insure only a dwelling. Dwelling coverage is the portion of your homeowners insurance policy that helps pay to rebuild or repair the physical structure of your home in the event of a covered loss. As such these policies can be more affordable for property owners.

The insurance company agrees to pay the policyholder for the costs to rebuild or repair the structure of the home for any damage resulting from a covered peril. This substrain of coverage is sometimes called tenant-occupied dwelling coverage You can add named perils to these policies such as vandalism broken glass burst pipes or water damage. Dwelling insurance is specifically designed to provide coverage in this circumstance.

Dwelling coverage includes all attached structures such as a garage or porch as well as built-in appliances such as a water heater should. Under this coverage the insurance company shall pay for the expenses of rebuilding or repairing the damaged structure if a covered peril causes the damage. The DP1 insurance policy is the most basic insurance policy available for rental properties in the United States.

The amount of property insurance listed under Coverage B on your policy is usually 10 of the amount of insurance you have chosen for the main structure - Coverage A. Dwelling insurance is a part of your standard homeowners insurance policy. The renter will buy separate coverage to insure their own belongings.

Dwelling insurance also known as dwelling coverage or Coverage A is the portion of your homeowners policy that covers repairing or rebuilding your home after its damaged by a covered peril such as fire. It provides very basic insurance coverage for rental properties. Dwelling coverage is the part of homeowners insurance policies that provides protection against damages to the physical structure of a home and the fixtures inside.

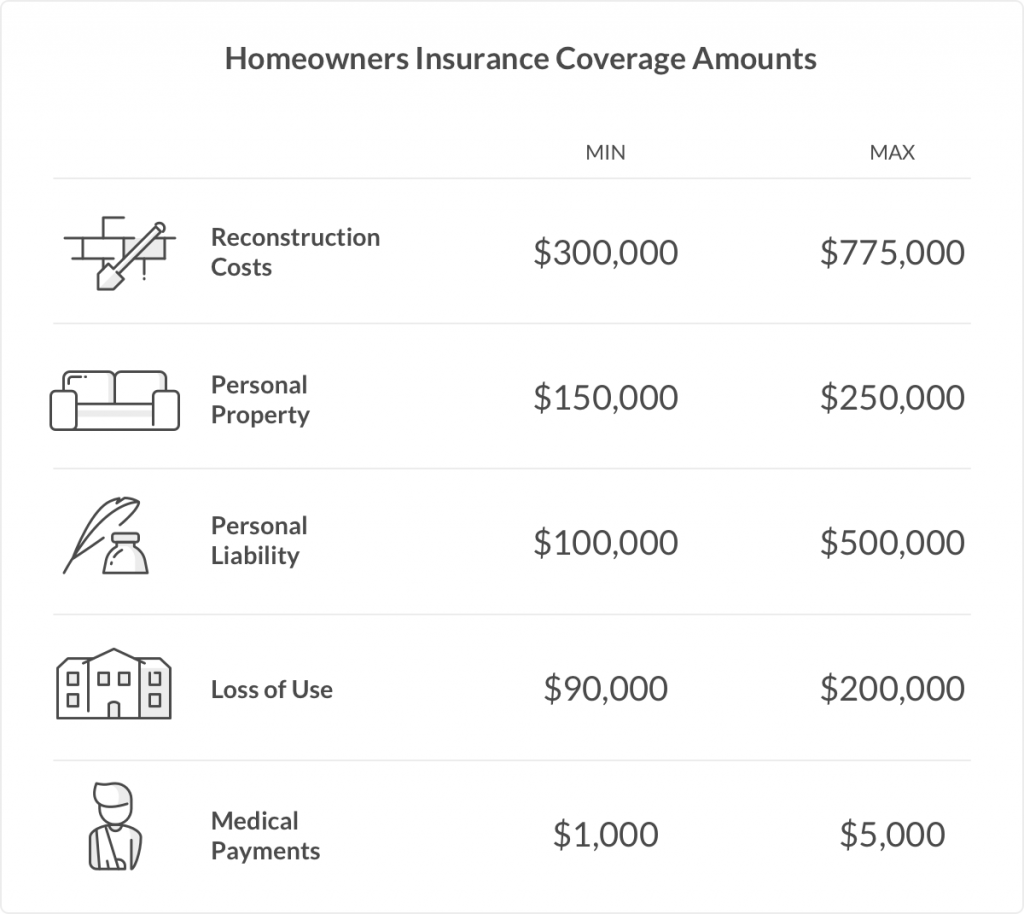

Dwelling coverage sometimes called Coverage A is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind hail lightning or fire. Heres a quick explanation of dwelling coverage. This policy is often referred to as Dwelling Fire Form 1 or DP-1 insurance.

Dwelling insurance is the part of the policy that helps you pay to repair or rebuild your home along with structures attached to your home like a garage or porch in the event of a covered loss. It covers your homes structure not its contents or land. DP1 Policy is Very Basic.

Dwelling insurance allows you to pick and choose the various coverages to apply to your property. The term Dwelling Extension in a homeowner policy is also commonly expressed as Other Structures. Dwelling Property Coverage Forms alternative forms to homeowners policies that may be used to insure physical damage to dwellings and personal property.

It doesnt cover any surrounding property or any personal items contained inside the dwelling. A standard dwelling policy only covers the dwelling itself with other coverages as optional add-ons. Examples include a detached garage tool shed driveway swimming pool gazebo or.

It covers the structure of your home as well as specific perils that can damage your property. Features like installed fixtures and permanently attached appliances are also covered. Liability coverage for instance doesnt come standard but can be added via an endorsement.

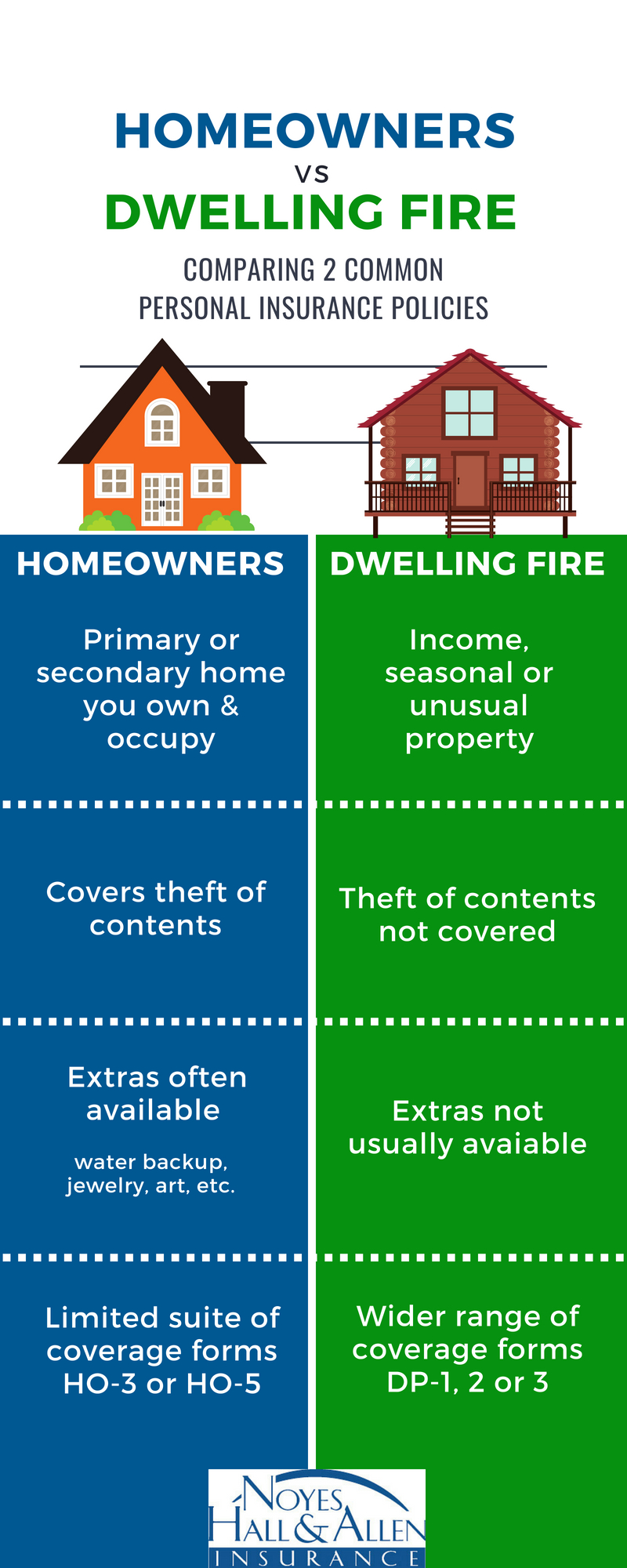

A dwelling fire insurance policy offers narrower coverage more specifically tailored to property damage coverage in the event of specific hazards. A dwelling policy offers relatively flexible coverage. Standard homeowners insurance however does not cover damage from floods or earthquakes.

Dwelling fire insurance offers property owners a wide variety of coverage options and flexibility to protect their assets. The definition of insured on an insurance policy includes dependents like children. Dwelling coverage is one part of your overall home insurance policy.

Other Structures homeowners policy coverage part covering structures on the residence premises separated from the dwelling by a clear space or connected to the dwelling by a fence utility line or related connection.

Home Insurance Breakdown What Is Coverage A Dwelling

Loss Of Use Coverage In Home Insurance Know The Rules

What Is Dwelling Insurance Coverage For Homes The Hartford

What Is The Difference Between Ho2 And Ho3 Homeowners Policies

What Is Dwelling Coverage In Homeowners Insurance

Understanding Dwelling Homeowners Insurance Policies Strategic Insurance Agency

Hazard Insurance Homeowners Dwelling Fire Policy Difference Portland Me Noyes Hall Allen Insurance

Types Of Homeowners Insurance Hippo

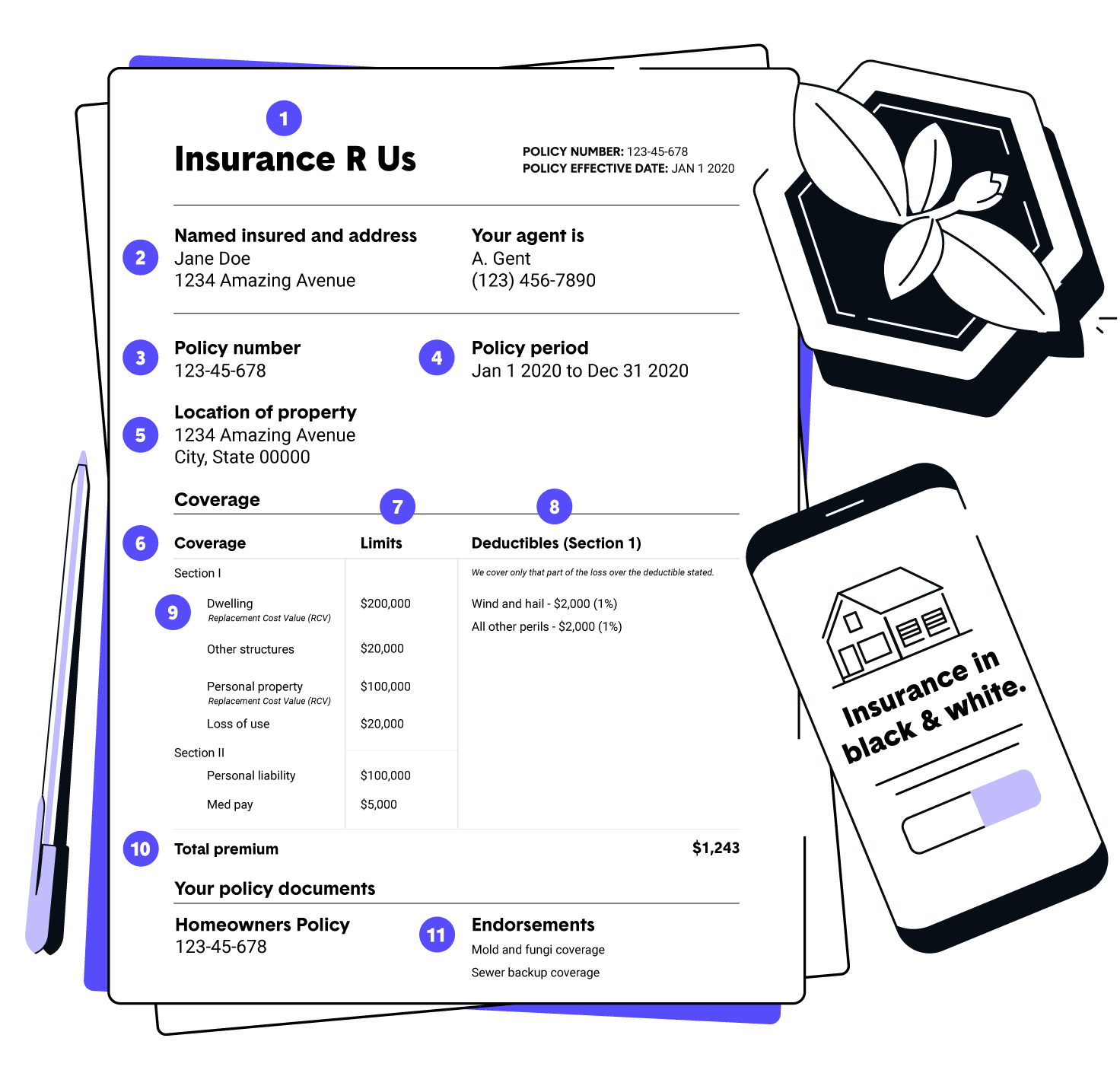

How To Read A Homeowners Insurance Policy The Zebra

Pin On Home Insurance Home Buying

What Is Dwelling Insurance Allstate Insurance Youtube

What Is Dwelling Insurance Coverage For Homes The Hartford

What Is Dwelling Fire Insurance

What Is Dwelling Insurance Valuepenguin

Unendorsed Homeowners Policy Faqs Guide

What Is Dwelling Coverage Insuropedia By Lemonade

Post a Comment for "Insurance Policy Definition Of Dwelling"