Employment Insurance Emergency Response Benefit Reporting

However the Benefit is only available for. The remission order was approved by the Administrator in Council on.

Have Questions About Canada Emergency Response Benefit This Lawyer Has Answers Cbc News

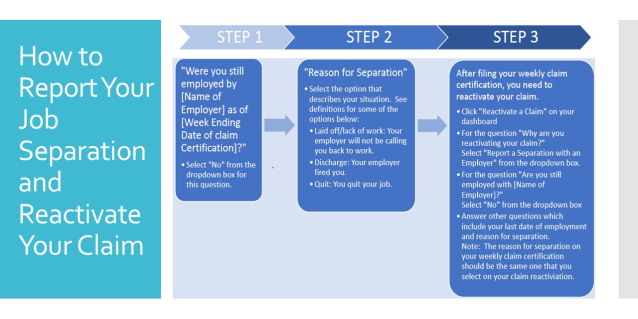

These steps address how employees will transition.

Employment insurance emergency response benefit reporting. We will try to explain how it works. Most importantly it allows persons in the self-employment category to receive support. CANADA EMERGENCY RESPONSE BENEFIT.

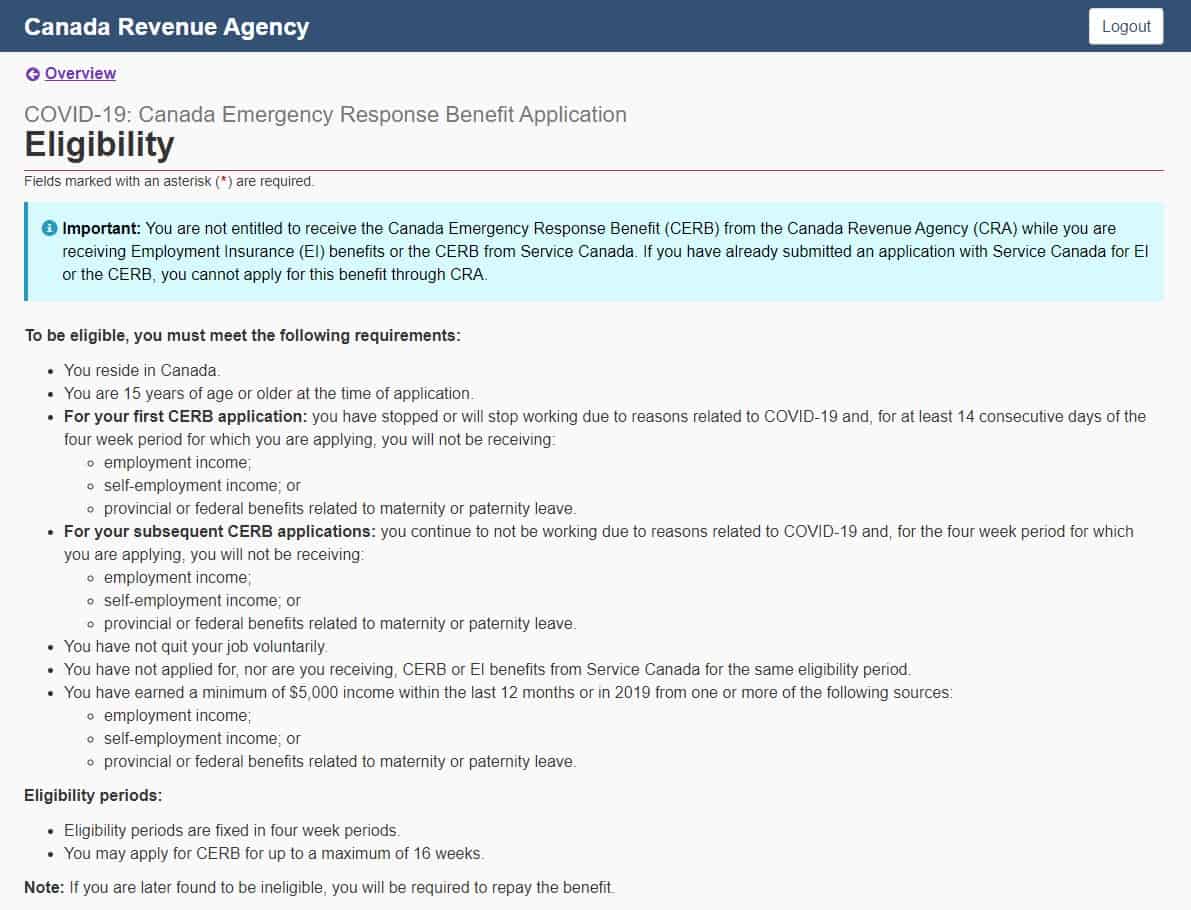

Those who were already approved for or are receiving EI as of March 15 will be continuing with that program only which necessitates online or telephone reports every two weeks to show that they are still eligible. If you were eligible you could have received 2000 for a 4-week period the same as 500 a week. For the health and safety of our clients all classes and in-person meetings will be cancelled until further notice.

Darryl DyckThe Canadian Press Now that the Canada emergency response benefit CERB has wound down people who are still jobless are. Remission employment insurance emergency response benefit 2 1 Remission of employment insurance emergency response benefit payments that are repaid or to be repaid under section 43 of the Employment Insurance Act or that are returned or to be returned under section 44 of that Act is granted to any person who meets the following conditions. 153111 - Employment Insurance Operating Account.

Generally in order to qualify you must have. You could receive up to 55 of your earnings up to a maximum of 573 a week. Simplified employment insurance program Canadian individuals may benefit from an extension of the Canada emergency response benefit CERB program and a temporary simplification regarding employment insurance EI.

How the CERB is taxed. Employment Insurance Emergency Response Benefit. 1535 - PART VIII4 - Employment Insurance Emergency Response Benefit.

The Canada Emergency Response Benefit CERB provides more Canadians with access to benefits versus the fairly narrow employment insurance scheme. The government has created a new Canada Emergency Response Benefit CERB to help workers impacted by COVID-19. There have also been changes to Employment Insurance EI.

QA FOR THE ADCP. CUPE is in constant communication with the government on Employment Insurance EI and the Canada Emergency Response Benefit CERB. Sending your CERB payment back.

EI sickness benefits provide up to 15 weeks of income replacement and is available to eligible claimants who are unable to work because of illness injury or quarantine. 1537 - Employment Insurance Emergency Response Benefit. Payment 1537 1 An employment insurance emergency response benefit is payable to a claimant who makes a claim under section 1538 and who is eligible for the benefit.

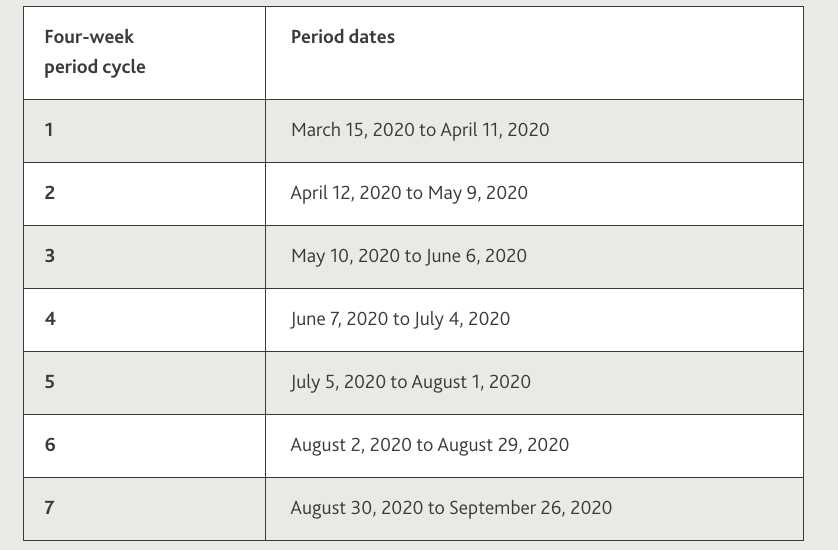

15312 - Social Insurance Number. Things are changing fast and some of the changes are still not clear. To aid Canadians in this transition CERB has been extended by an additional four weeks to a maximum of 28 weeks.

Navigating The Canadian Emergency Response Benefit CERB and Employment Insurance EI Please Note. We need your ROEs as soon as possible to determine if you qualify for EI benefits and how much youll receive. The Canada Emergency Response Benefit and Employment Insurance Emergency Response Benefit Remission Order grants relief of the collection of certain overpayments and certain payments of the CERB for self-employed individuals who applied for the CERB and would have qualified based on their gross income.

You or your employers must submit a record of employment ROE for each job you had in the 52 weeks before the beginning of your CERB. If you are not eligible for Employment Insurance regular or sickness benefits and lost your job prior to March 15th you may be eligible for the Canada Emergency Response Benefit delivered by the Canada Revenue Agency. Information is constantly updating and we are receiving more information everyday.

Make sure to ask your employer for your Record of Employment which you will need to apply. In the latest evolution of the federal governments response to the ongoing global COVID-19 pandemic on August 19 2020 amendments to the Employment Insurance Act EI Act were published and on August 20 2020 the government announced new measures to support affected Canadians who continue to be unable to work due to COVID-19. On August 20 2020 the Government of Canada announced further details on their plan to transition from the Canada Emergency Response Benefit CERB to Employment Insurance EI.

Additionally changes are being made to the existing EI. Remission employment insurance emergency response benefit 2 1 Remission of employment insurance emergency response benefit payments that are repaid or to be repaid under section 43 of the Employment Insurance Act or that are returned or to be returned under section 44 of that Act is granted to any person who meets the following conditions. Shleea April 9 2020.

Simplified employment insurance program emergency response benefit program COVID-19 Canada. The Canada Emergency Response Benefit CERB provided financial support to employed and self-employed Canadians who were directly affected by COVID-19. 153121 - Benefit Period.

1531310 - Special Rules. Reporting through EI CERB would mean 1000 every 2 weeks vs 2000 every 4 weeks CRA CERB. Payments in advance 11 The Commission may pay the employment insurance emergency response benefit in advance of the.

How To Apply For The 2k Month Cerb And Cerb Extension Savvy New Canadians

Demystifying The Canada Emergency Response Benefit Cerb Lexology

How To Do Your Ei Bi Weekly Report Receive Employment Insurance Benefits For Internet Reporting Youtube

Canada Emergency Response Benefit Cerb For Temporary Foreign Workers And International Students Sps Canada

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/GQZXWIHVMREOFN4XVT3UWUCTTU.jpg)

How To Apply For Ei And Other Covid 19 Emergency Government Income Supports The Globe And Mail

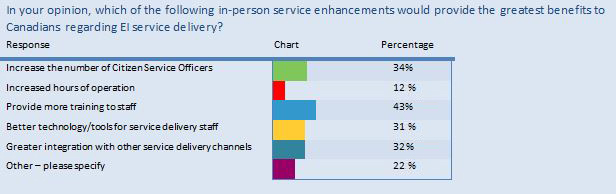

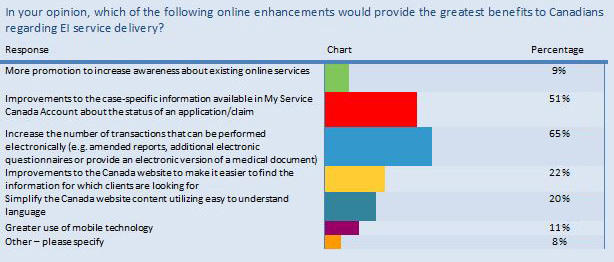

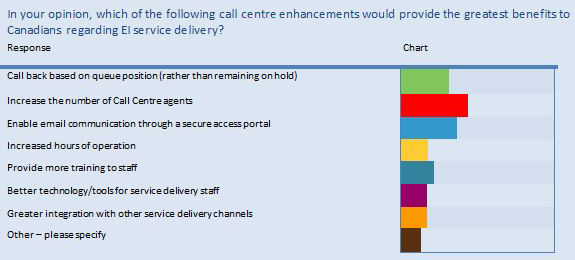

Employment Insurance Service Quality Review Report Making Citizens Central Canada Ca

Canada Emergency Response Benefit Cerb For Temporary Foreign Workers And International Students Sps Canada

Employment Insurance Service Quality Review Report Making Citizens Central Canada Ca

Https Www Unifor Org Sites Default Files Documents Document Covid 19 Cerb 2020 06 26 Pdf

Employment Insurance Service Quality Review Report Making Citizens Central Canada Ca

Employment Insurance Service Quality Review Report Making Citizens Central Canada Ca

What Happens If Employer Fails To Issue Roe On Time Dutton Employment Law

30 000 Self Employed People May Not Have To Repay Cerb Canada S National Observer News Analysis

Canada Emergency Response Benefit Cerb For Temporary Foreign Workers And International Students Sps Canada

Covid 19 Update Canada Emergency Response Benefit Fbc

How To Fill Out Your Ei Internet Report Dutton Employment Law

Canada Emergency Response Benefit Cerb For Temporary Foreign Workers And International Students Sps Canada

Post a Comment for "Employment Insurance Emergency Response Benefit Reporting"